Keeping track of cash flow is crucial for any business, especially those that deal with physical currency on a daily basis. A printable daily cash drawer count sheet can help streamline this process and ensure accuracy in financial transactions. By using a standardized template, employees can easily record cash amounts at the beginning and end of each shift, as well as document any discrepancies or shortages.

Having a daily cash drawer count sheet also serves as a paper trail for auditing purposes and can help with identifying any potential discrepancies or fraudulent activities. It provides a clear record of cash transactions and can help businesses maintain transparency and accountability in their financial operations.

How to Implement a Printable Daily Cash Drawer Count Sheet

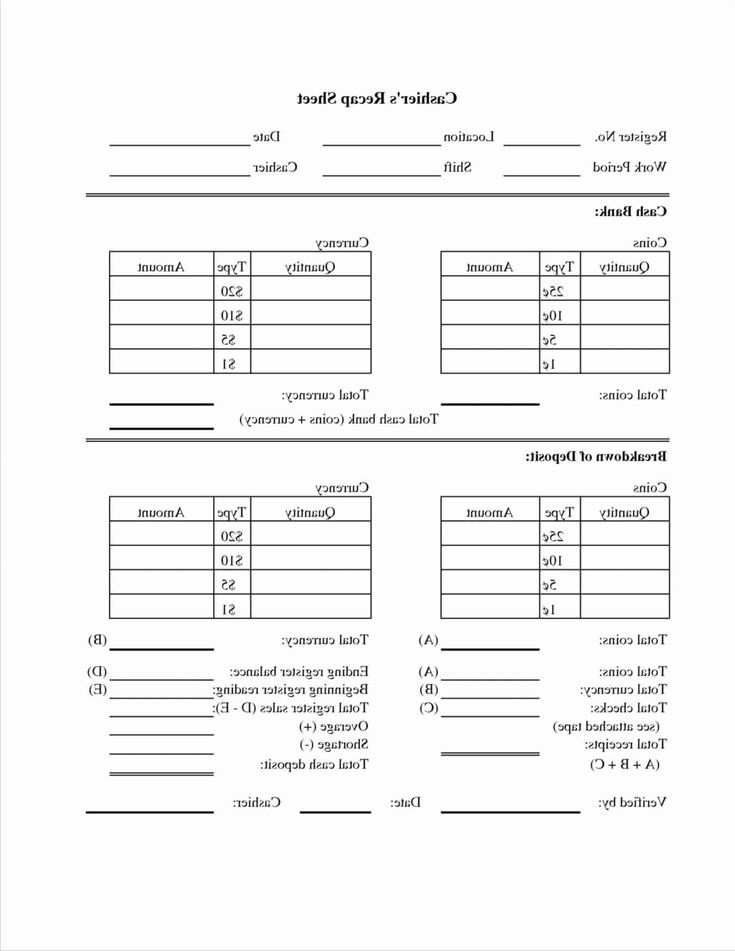

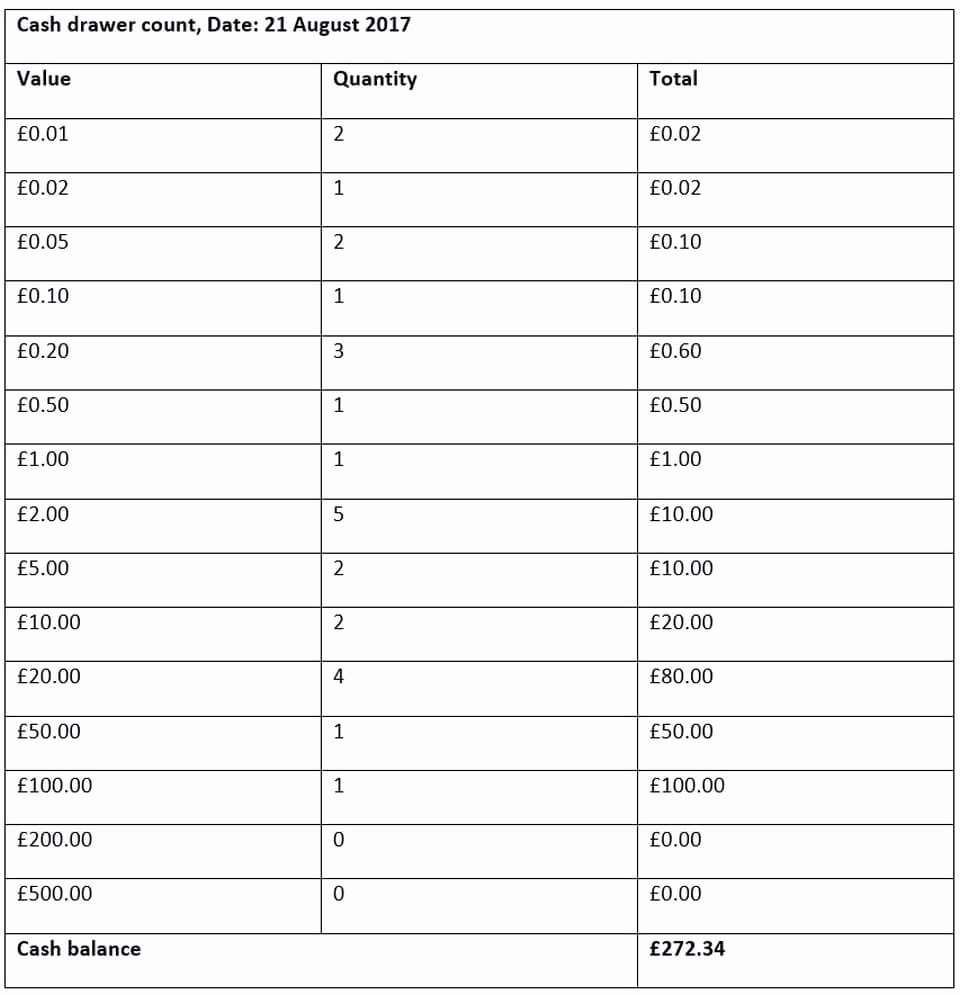

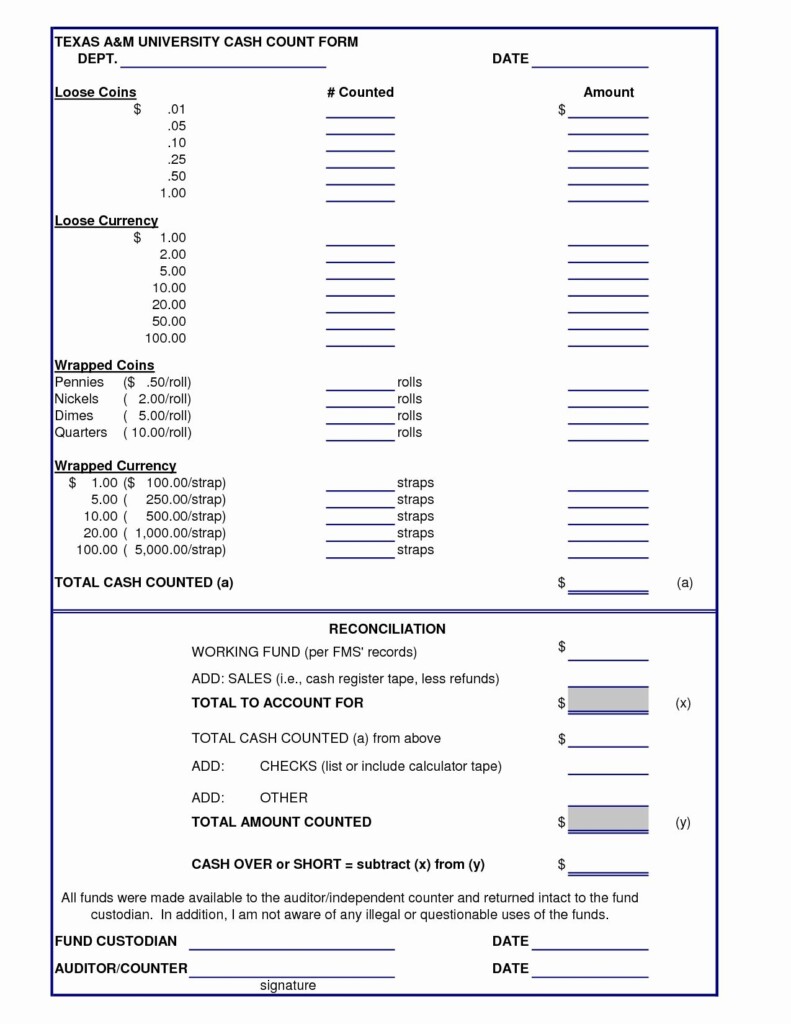

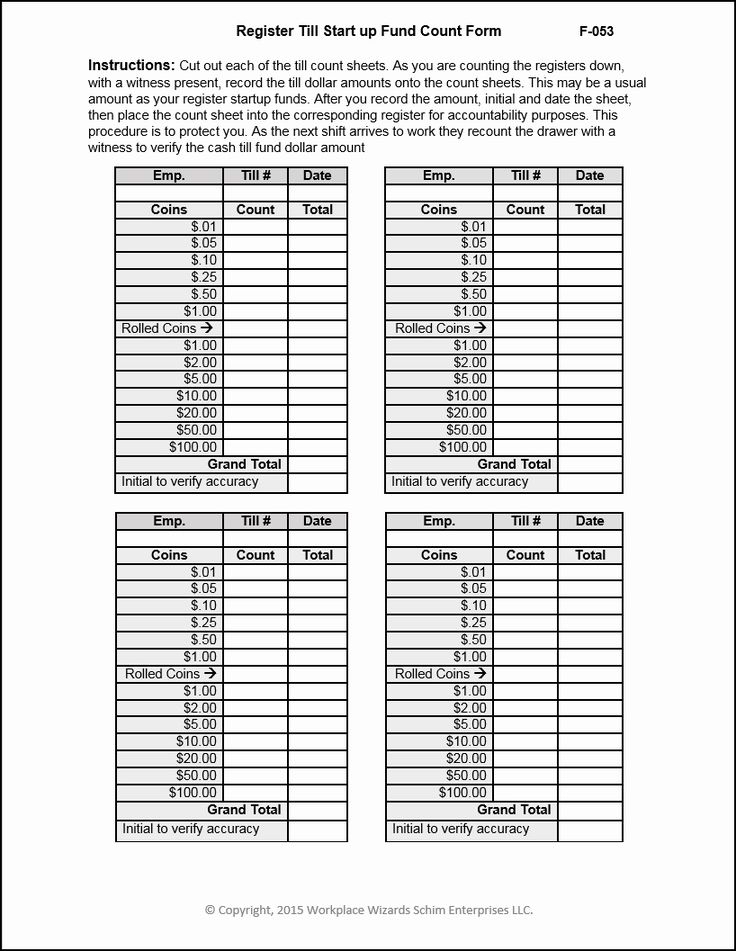

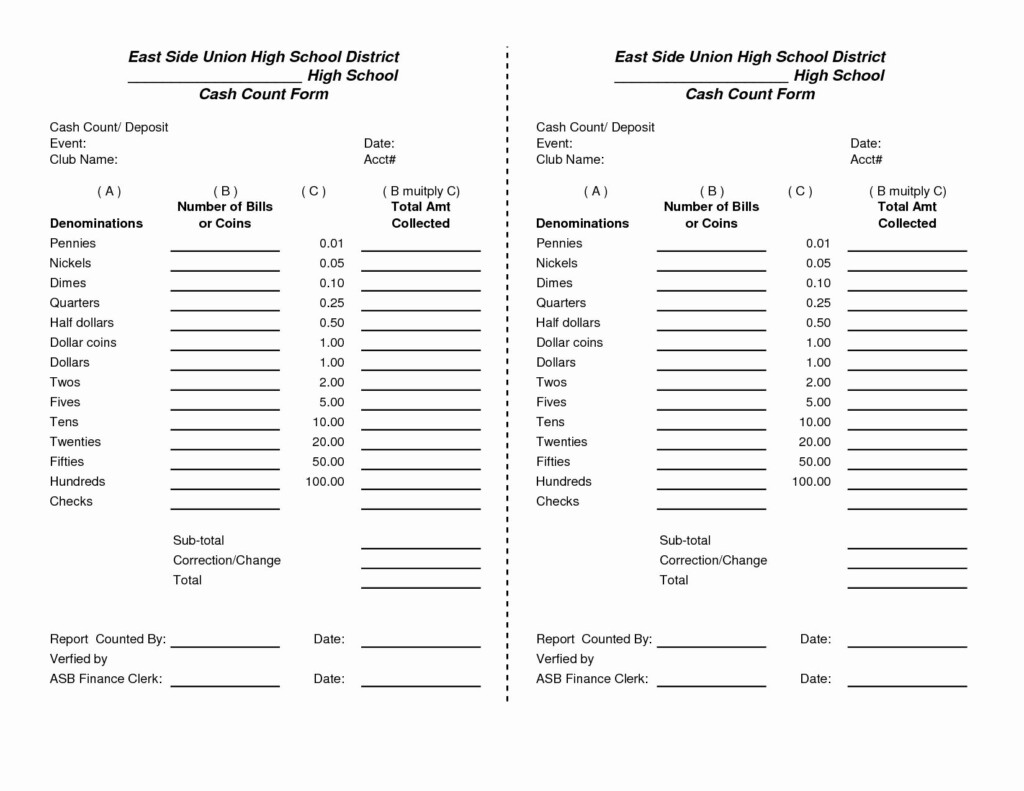

To implement a printable daily cash drawer count sheet, businesses can download a template online or create their own customized version. The sheet should include sections for recording starting cash amounts, cash transactions throughout the day, and ending cash totals. It should also have space for employees to document any discrepancies, as well as a signature line for verification.

Businesses can choose to use a digital version of the count sheet that can be filled out electronically or opt for a physical printout that can be manually completed. Whichever method is chosen, it is important to ensure that the count sheet is easily accessible to employees and that proper training is provided on how to use it effectively. By implementing a daily cash drawer count sheet, businesses can improve financial accountability and reduce the risk of errors or fraud.

Benefits of Using a Printable Daily Cash Drawer Count Sheet

Using a printable daily cash drawer count sheet offers several benefits for businesses, including increased accuracy in cash handling, improved financial transparency, and enhanced accountability among employees. By having a standardized process in place for tracking cash flow, businesses can better monitor their financial health and identify any potential issues before they escalate.

Additionally, a daily cash drawer count sheet can help businesses comply with regulatory requirements and demonstrate good financial practices to stakeholders. It can also serve as a valuable tool for identifying trends in cash transactions and making informed decisions about cash management strategies. Overall, implementing a printable daily cash drawer count sheet can help businesses operate more efficiently and effectively in their financial operations.

By utilizing a printable daily cash drawer count sheet, businesses can streamline their cash handling processes, improve financial accountability, and maintain accurate records of cash transactions. This tool can help businesses track cash flow, identify discrepancies, and ensure compliance with financial regulations. Implementing a daily count sheet can lead to better financial transparency and improved decision-making for businesses that deal with physical currency on a regular basis.